Indian Coal

Introduction

Coal is the predominant source of power generation in the country and is intricately linked to its energy security. Over the period of time, coal has been the preferred choice of fuel due to its abundance, availability and affordability.

At present, 50% of India’s installed capacity for power generation is coal-based.

The country procures bulk of its coal consumption domestically, while imports are necessitated to fill the supply-gap emerging from lack of coking coal reserves and to meet the high-quality material requirement of various end-user industries.

Amidst rising energy demand and a declared commitment to provide electricity to all, India is expediting coal production from the available resources.

In addition, economic growth led by higher demand for infrastructure development would further boost coal requirement in various allied industries such as cement, sponge and steel. The demand for coal in the country is expected to be in the range of 1.3-1.5 billion tonnes by 2030.

Role of CIL

Coal is the predominant source of power generation in the country and is intricately linked to its energy security. Over the period of time, coal has been the preferred choice of fuel due to its abundance, availability and affordability. The domestic production is dominated by state-owned mining companies-CIL and SCCL.

‘Others’ refers to mix bag of small-scale merchant and captive miners which operates coal mines allocated to them by the government. They produce only 6% of the domestic coal by volume. Of these, CIL holds significance as it caters almost 80% of the country’s total coal production. Founded in November 1975, the company had started mining activities with a modest coal production of 79 million tonne (mnt) at its year of inception.

Since then, it has emerged as one of the major coal producer in the globe and had attained its highest ever output of 622 mnt in Fy22.

CIL Mining Structure

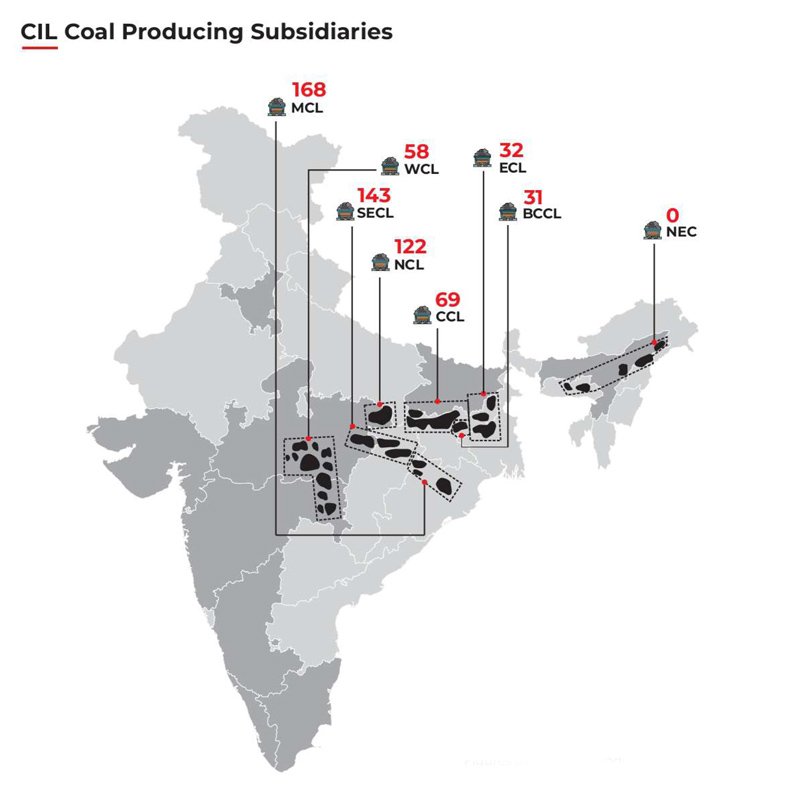

CIL has ten fully owned Indian subsidiary companies, and one foreign subsidiary in Mozambique namely Coal India Africana Limitada (CIAL).

Of these, the 7 coal producing subsidiaries are ECL, BCCL, CCC, WCL, MCL, SECL, and NCC.

Further, the company CIL has four Joint Venture companies- Hindustan Urvarak &

Rasayan Limited, Talcher Fertilizers Ltd., CIL NTPC Urja Pvt. Ltd. and Coal Lignite Urja ,

Vikas Private Limited.

Subsidiaries

Eastern Coalfields Ltd (ECL)

Central Coalfields Ltd (CCL)

Bharat Coking Coal Ltd (BCCL)

Mahanadi Coalfields Ltd (MCL)

Northern Colafields Ltd (NCL)

South Eastern Coalfields Ltd (SECL)

Central Mine Planning & Design Institute Ltd (CMPDIL)

IL Navi karniya Urja Ltd

CIL Solar PV Ltd

Coal India African Limitada (CIAL)

Jharkhand Central Railway Ltd (ECL)

MNH Shakti Ltd

Mahanandi Basin Power Ltd

Mahanandi Coal Railway Ltd

MJSJ Coal Ltd

Chhattisgarh East Railway Ltd

Chhattisgarh East West Railway Ltd

Joint Ventures

Hindustan Urvarak & Rasayan Ltd

Talcher Fertilizer Ltd

CIL NTPC Urja Pvt Ltd

Coal Lignite Urja Vikas Pvt Ltd

That apart, CIL also operates coal mines in Assam under its flagship company named North Eastern Coalfields (NEC).

CIL carries out coal mining activities through its subsidiaries in 84 mining areas that are spread over eight states of India. As on 1 April 2022, CIL has 318 mines of which 141 are underground, 158 opencast, and 19 mixed mines.

These companies operate mining operation at varied volumes depending upon allocation of mines and the available geological reserves, and are responsible coal extraction and sales to the customers.

Coal Sale Mechanism

CIL has two broad channels for coal sales: Fuel Supply Agreements (FSAs) and EAuctions.

Of these, majority of the coal is sold through the FSAs. These include long term supply contracts meant for thermal power plants and other large scale industries, which require uninterrupted coal supply for running their operations.

CIL also conducts linkage auctions on a timely basis for both power and non-power sectors, which also comes under FSAs.

Coal procurement via regular e-auctions is based on forward-based bidding process. This route of coal sale is applicable to the entire gamut of buyers including traders but is extensively used by small-scale industries to satiate their demand.

The basic difference between linkage auction and regular auctions is the tenure of coal allocation. The regular auctions offer coal for a short duration, whereas linkage auctions

Earlier, there were five separate auction windows which cater to the requirement of different set of customers. These were: Spot, Exclusive and Special Forward, Special Spot, and Special Spot for ‘Coal Importers’.

However, by introducing reforms in the existing sales process, these auctions have been merged under a single window under Spot scheme from March, 2022 onwards.

Why Index is needed?

The domestic coal structure in India is grappled with inconsistencies.

Firstly, the coal grades are defined in range of GCV, so it is difficult to compute coal value accurate to a fixed GCV value.

Secondly, there is discrepancy with regards to coal pricing too.

Notably, CIL notified price are defined separately for regulated (power) and non regulated sector. Adding to that, due to cost considerations, different notified price dispensation has been made for WCL coal.

In addition, the individual subsidiaries of CIL produce different grades of coal depending on the available reserves. Besides, these coal grades are not offered on a consistent basis in the auctions for which there is variable reserve prices.

So, there remains an absence of efficient mechanism to monitor the market condition and to compare the domestic prices.

Definition of Indian Coal Index

In order to address the discrepancy in coal pricing and gradation structure, Indian Coal Index has been formulated.

The Index is meant to encompass transactions of sale via regular auctions (excluding linkage auctions) conducted by CIL subsidiaries by collecting the bid prices quoted against the offered lot of coal in a month.

These auctions cover around 20% of the total volume that is produced annually by CIL.

PC-OB

Since, notified price is of fixed nature, the bid prices offer true reflective of market condition as the bidding encapsulates real-time data based on prevailing supplydemand dynamics.

These prices include non-coking coal grades, whereas coking coal grades are excluded. The index has been prepared with an objective to provide base indicator for comparison and align the domestic coal grades with the global specifications.

Methodology

The process involves collection of data comprising bid prices and sale volume across various coal auctions conducted by CIL subsidiaries.

After data standardization, Representative Price (RP) is calculated against each grade by using suitable weights.

Thereafter, these individual grade-wise prices are clubbed into sub-categories, and further normalized to derive final index for various CCV bands by applying weights.

- Methodology Flow Process -

Step 1

Data Collection

Step 2

Data Standardisation

Step 3

Computation of Representative Price

Step 4

Segregation of Representative Prices into ICI Grade Bands

Step 5

Normalising Representative Prices to Equivalent GCV

Step 6

Computation of Final Index

The weights used are volume-based, but are applied differently for computation of RPs and final indices.

- In case of RP, the weights are based on sale volume taken for individual subsidiaries.

- For Final index, the weights are based on sale volume taken for individual grades.

Price Index

The various non-coking grades are segregated into five sub-categories which form distinct price index for computation. These are:

- Premium High Grade (C 6000)

- High Grade (G 5500)

- Medium Grade (G 4800)

- Moderate Low Grade (C 3500)

- Low Grade (G 2600)